-

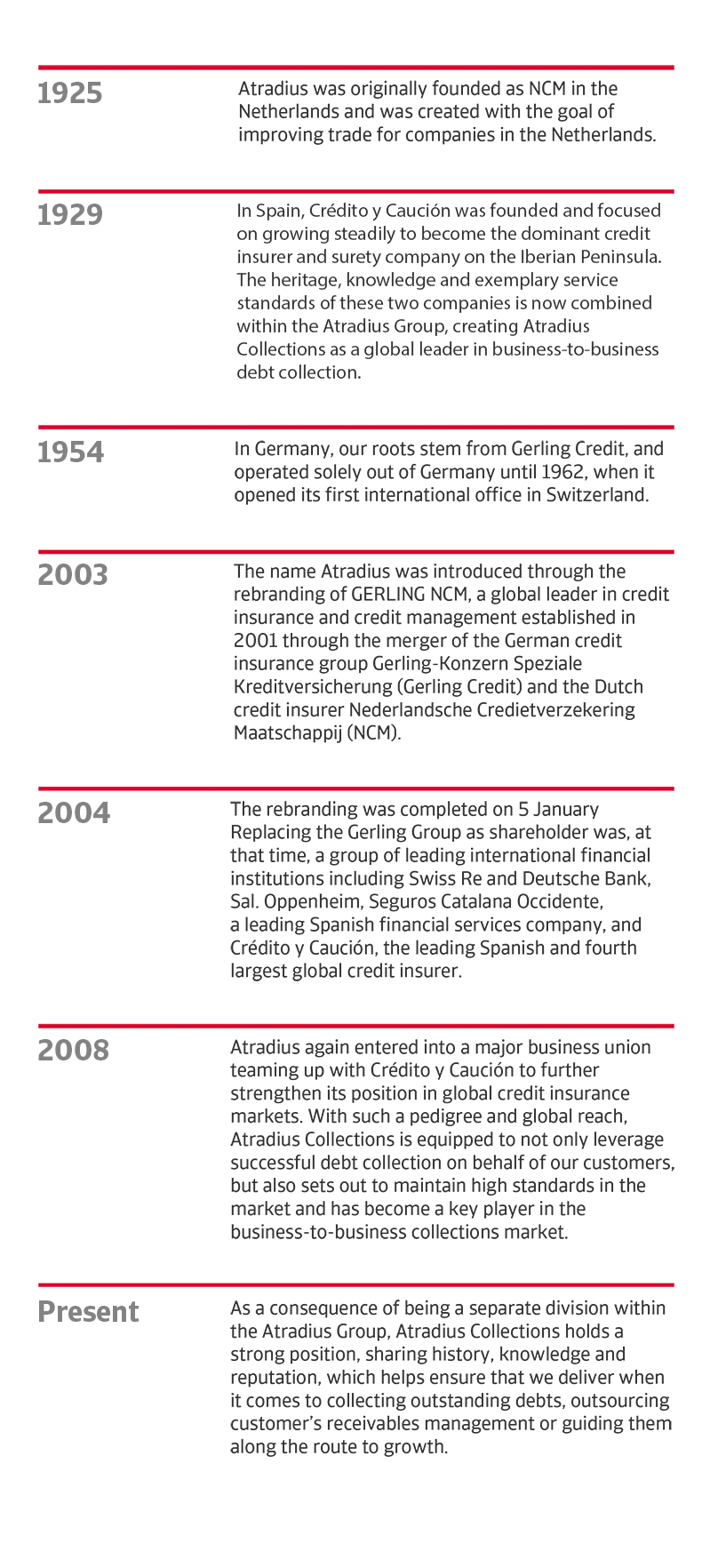

Atradius Collections is a key holding company within the business, Atradius N.V. and works closely alongside our colleagues in Atradius Credit Insurance and Atradius Reinsurance.

-

As part of the Atradius Group, we enjoy more than 90 years of global credit management industry experience and maintain a strong position, sharing history, knowledge and reputation. This helps ensure we deliver when it comes to collecting outstanding debts, outsourcing customers’ receivables management or guiding them along the route to growth.

More about Atradius Collections

-

World leading commercial debt collection agency

-

Well-established global business with 90+ years of quality credit management experience

-

Great success in collecting debts for our clients worldwide; and pride ourselves on our high-quality services

-

This has enabled us to become a key player in the business-to-business debt collection market

Watch this short video for more insights:

You are in good hands

As an experienced and professional debt collection agency, we know that a proactive and sensitive approach often yields the best result.

We strive to:

-

Handle your requests well and with care

-

Recover your debts in a timely manner

-

Retain the business relationships you have with your customers

Start collecting now

About Atradius Collections

-

Atradius Collections is part of a well-established global business that has been promoting secure trade through quality credit insurance and credit management services for more than 90 years.

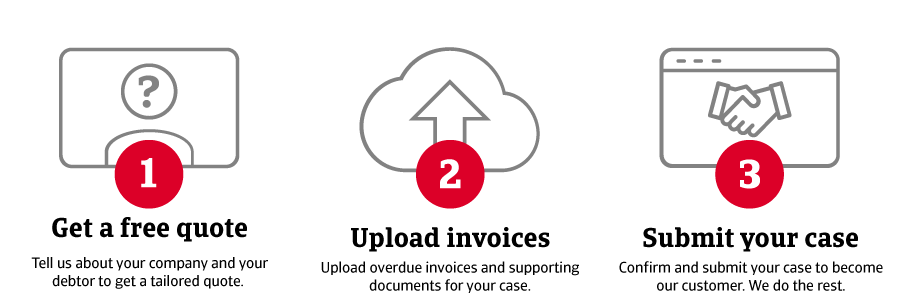

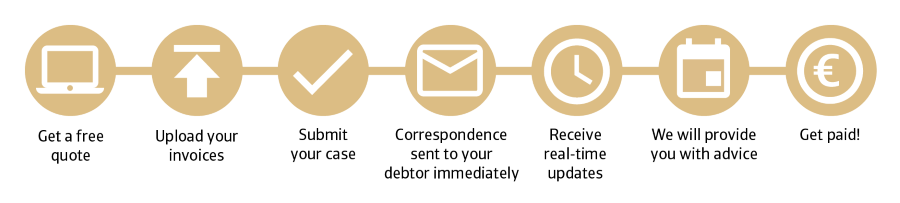

How we work with you

Our web-platform also let you track the progress of your cases and view the development of your portfolio. If you need an update on our activity you can also get it there at any time.

Our debt collection activity will start immediately with a combination of telephone calls and demand letters, the fre-quency is detailed below and is based on the debt value, chance of success, debtors response and the culture and laws of each country.

Within 30 days of receiving your case, we will give you our recommendations for next steps.

We want to collect your money as quickly as possible, so whilst we will always aim to recover the full amount immediately, if this is not possible, you authorise us to agree actions on your behalf, such as payment plans and full and final settlements for any debt where the total outstanding amount is less that €50,000.00.

We will not start any legal action or incur further costs without seeking your prior approval.

We will inform you when we close your case and give you information about our activity and the reason for the closure.

We will come back to you if we need more documentation or information to allow us to continue with our action. Please come back to us as quickly as possible. We reserve the right to close the case if we don’t hear from you within 14 days and you may be charged a withdrawal fee.

If you receive payment directly from your debtor, please let us know within 48 hours of receipt via the dashboard on the platform with details of the payment so that we can adjust our collection strategy.

Visibility

Visibility

Our Activity

Our Activity

Your input

Your input

Download your service level agreement

Download your service level agreement